Indexes for Options Trading in India: Option trading has gained immense popularity in India in recent years and people are also enjoying option trading in indexes.

Index options trading offers Investors and traders a wide range of opportunities for speculation and portfolio management. And also offers traders the opportunity to profit from price movements in the financial market.

In index options trading anything can happen profit or loss, it‘s quite risky but it depends on your risk management, that’s why you should learn the right trading strategy in advance.

In this article, I am going to tell you about the 5 best indexes for options trading. Many experienced traders and beginners also like to trade in these indexes because they have high volatility, leverage and liquidity.

What is index options trading?

Index options trading gives the right to the buyer but not the obligation to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) within a specific time frame (expiration date).

Index trading refers to the practice of buying and selling of financial instruments that are designed to track the performance of a specific market index and the market index is a hypothetical portfolio of stocks bonds or their security that represent a particular segment of the financial market.

There are 2 types of index option trading:

- Call Options: This option gives the holder the right to buy an underlying index at a predetermined price (strike price) before the date of expiry.

- Put Options: This option gives the holder the right to sell an underlying index at a predetermined price (strike price) before the date of expiry.

The financial performance of a company is one of the criteria to know the economic development of a country, but there are thousands of companies listed in the stock market.

So, if you want to know the performance of the market, it’s difficult to track every company at a time, hence a sample was taken. It’s taken by the company which represents the entire market and this small sample is called index. [Indexes for Options Trading in India]

List of 5 best indexes for options trading in India:

- Bank Nifty

- Nifty 50

- Sensex

- Finnifty

- Nifty Midcap Select

1. BANKNIFTY

- Bank Nifty is an index which helps us to understand the performance of banking sectors.

- Bank Nifty is created by the NSE (National Stock Exchange).

- In the year 2000, IISL (India Index Services & Products Ltd.) had started the Bank Nifty Index in the stock market with a base value of 1,000, which today’s value is 46,000, which has increased 46 times in 24 years.

- The lot size of Bank Nifty, 1 Lot = 15 Quantity.

- The expiry day of Bank Nifty, Wednesday of every week.

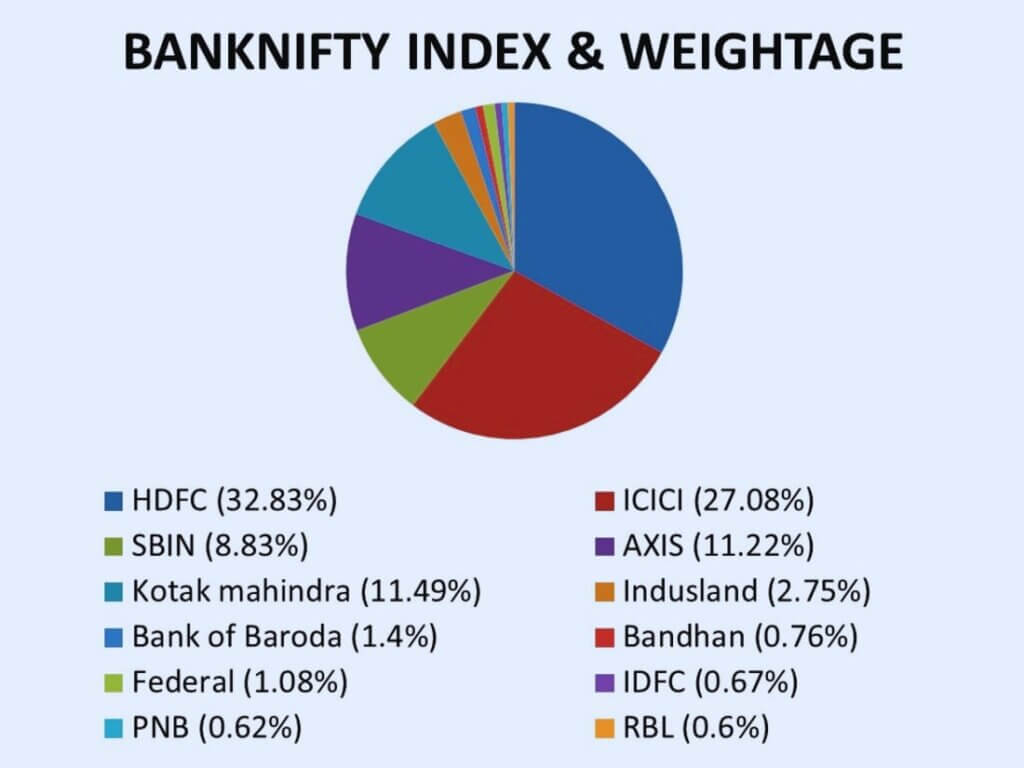

- Total 12 banks are included in Bank Nifty which are HDFC Bank, ICICI Bank, SBIN, AXIS Bank, Kotak Mahindra Bank, IndusInd Bank, Bank of Baroda, Bandhan Bank, Federal Bank, IDFC First, PNB and RBL.

The objective behind creating Bank Nifty was to progress the banking sector of India and to further strengthen the position of the Indian market in the banking sector, that’s why the Bank Nifty Index was introduced in the stock market.

Index cannot be bought but Bank Nifty is so famous because it can be invested in by index funds and can also be traded in the futures and options market.

Nowadays, Bank Nifty is mostly used in intraday trading in which shares are bought and sold on the same day.

Along with this, Bank Nifty has also been created so that we can track the growth, performance and progress of banks. [Indexes for Options Trading in India]

2. NIFTY 50

- Nifty 50 is an index that helps us to track the performance of 50 large and actively trading Indian companies and Nifty 50 is a benchmark of the stock market index which is listed on the NSE.

- Nifty 50 is created by the NSE (National Stock Exchange).

- NSE started Nifty 50 in 1996 with a value of 1000, which today’s value is 22,000, which has increased almost 22 times in 27 years.

- The lot size of nifty 50, 1 Lot = 50 Quantity.

- The expiry day of nifty 50, Thursday of every week.

The value of a single share of a company multiplied by total number of shares of that company, will give you the market capitalization of that company.

From this figure, if we minus the value held by the promoters, it becomes free float market capitalization.

As per the free float market capitalization when we create a list of companies in descending order then the top 50 companies is known as Nifty 50.

In all the indexes, the weightage of every company is different. For example, the weightage of Reliance in nifty 50 is almost 15%.

It means the last company of the Nifty or the 50th company, if it crashes it doesn’t mean that Nifty will also fall. But if Reliance hits a big crash the Nifty will also fall, because its weightage in Nifty is more. [Indexes for Options Trading in India]

3. SENSEX

- Sensex (Sensitivity Index) helps to understand the performance of 30 companies with the biggest market cap listed on BSE.

- Sensex is created by the BSE (Bombay Stock Exchange).

- BSE started Sensex in 1979 with a value of 100, which today’s value is 72000, which has increased almost 720 times in 44 years.

- The lot size of Sensex, 1 Lot = 10 Quantity.

- The expiry day of Sensex, Friday of every week.

Sensex is also called BSE 30 because the top 30 companies are selected out of 5,500 companies on the basis of their market capitalization, companies like Infosys, ITC, Hero etc.

For example, if the market cap of a company has decreased a lot, and now it has not been in the top 30, then the Sensex will remove it from the list and will include some other company and the Nifty also works in the same way.

So, generally Sensex and Nifty tell us whether the market is rising or declining but it’s not very accurate because it only has 30 and 50 companies. But still, it conveys a general sentiment of the market. [Indexes for Options Trading in India]

Read Also: Best Time Frames for Option Trading in 2024

4. FINNIFTY

- Finnifty (Financial Services Index) is a finance Nifty, it has the weightage of 20 companies of insurance, banking and finance and also represents the financial market.

- Finnifty is also created by the NSE (National Stock Exchange).

- In the year 2019, NSE started Finnifty with a value of 1,000 which today’s value is 20,000, which has increased almost 20 times in 5 years.

- The lot size of Finnifty, 1 Lot = 40 Quantity.

- The expiry day of Finnifty, Tuesday of every week.

The premiums in Finnifty are very high due to misleading. The reason is that here the volume and liquidity are less compared to other indexes like Nifty and Bank Nifty because Finnifty is a relatively new instrument.

5. NIFTY MIDCAP SELECT

- Nifty Midcap Select is also an index to track the performance of 25 stocks.

- Nifty Midcap Select is also created by the NSE (National Stock Exchange).

- NSE started Nifty Mid Select in 2022 with a base value of 1,000, which today’s value is 10,000, which has increased almost 10 times in 2 years.

- The lot size of Nifty Mid Select, 1 Lot = 75 Quantity.

- The expiry day of Nifty Midcap Select, Monday of every week.

The biggest reason behind the launch of Nifty Midcap Select is to provide traders with significant exposure and derivatives hedging purposes. [Indexes for Options Trading in India]

What are the benefits of index options trading?

- Many traders pick index trading because of volume and liquidity. Whenever we talk about derivatives or the segment of future and option then you have to understand that the most liquidity or volume you will get only in indexes.

- Traders in the index easily enter and exit with large numbers of lots. Some people take help of algorithms, some take the help of excel sheets and some do it manually.

- Index options trading helps you which are hedging strategies and all the non-directional strategies get a lot of exposure through index trading.

- Leverage allows traders and investors for a substantial return potential to control a large position with less capital.

What are the risks of index options trading?

- Market risk fluctuations in the underlying index can lead to losses, especially if the market moves beyond your premium.

- Time decay is another factor, options have a specific date (expiration date), as time passes the options value may decrease, especially if the underlying index doesn’t move in a favorable direction.

- Index options trading can be complex with many different types of factors like volatility, liquidity including the price of an underlying index, expiration dates, open interests etc. You have to understand these factors, if you want to gain knowledge and experience in this financial market. [Indexes for Options Trading in India]

Conclusion

If you want to trade in indexes and you are a beginner then I would recommend you to trade with proper knowledge because it’s very risky. If you want to trade in an index then follow proper risk management.

Create your own setup or if you follow someone else’s setup, so follow their rules and regulations and keep improving your trading skills.

We hope you liked the information given by us. If you want to learn options trading or you are a beginner and you are learning, then you can also read our other articles.

Because this website is only on options trading, if you have any problem or you need any information related to options trading. So you can tell us by commenting below. [Indexes for Options Trading in India]

Frequently Asked Questions (FAQs)

1. Which Index is best for options trading?

Bank Nifty and Nifty 50 are the best indexes for options trading. Many traders and investors like to trade in indexes because of high volatility and liquidity.

2. Can we trade on Nifty index?

Yes, you can trade in Nifty 50 index. This index offers high volatility and liquidity with a variety of strike prices and expiry dates for trading strategies.

3. What is Nifty Options Trading?

Nifty 50 is an index that helps us to track the performance of 50 large and actively trading Indian companies and Nifty 50 is a benchmark of the stock market index which is listed on the NSE.

4. Which index is easy to trade?

Nifty 50 is one of the most popular index in the Indian stock market, because this index is easy to trade compared to other indexes.

5. Who invented Bank Nifty?

The Banknifty index was created by the NSE. In the year 2000, IISL (India Index Services & Products Ltd.) had started the Bank Nifty Index in the stock market.