Earn 2000 Daily in Intraday Trading: Yes, you can earn Rs 2000 per day sitting at home, it’s not impossible from intraday trading, for this you will have to do continuous learning and build your trading psychology.

When you practice in trading, you automatically start seeing new things, then you experiment with them, only then your trading skills will improve.

If you are aiming to earn 2000 per day in intraday trading then it requires a combination of discipline, patience, continuous learning and strategies.

So today in this article we will tell you some tricks through which you can easily earn Rs 2000 to Rs 3000 daily, that means you can withdraw 2 to 3% of your daily income, but for this you will have to be active in the market daily.

How Can I Earn 2000 Daily in Intraday Trading?

Let’s explore some tricks through which you can earn up to Rs 2000 per day safely and definitely you will not make profit on every trade and there will be loss also that’s why stop-loss is necessary.

But definitely, if you learn these tricks then your accuracy can improve to a great extent, depending on how much you practice it and embrace your mindset with it.

1. Choose Quality stocks

If you do intraday trading then there should be a minimum of 10 to 15 stocks which you observe and 10 to 15 stocks should be such which gives an average movement of 1 to 2% and all the main stocks should be such which have high volatility. The volume should be very high within the stocks and the involvement of big players on these stocks.

This means that you have to focus on all the stocks within Nifty 50, do not go out of it and avoid all the circuit stocks. If you observe 10 to 15 stocks daily which gives good movements. Those stocks have high volatility and which give 1 or 2% movement. When you are able to read these stocks only then you can make profit daily. [Earn 2000 Daily in Intraday Trading]

2. Develop a trading plan

By planning your trades before executing any trade is the best idea for every trader. Planning your trades can help you to stay focused and you will also know when to cover or cut your losses and when to book your profits.

Define your plans for every trade including target, profit and stop-loss. Identify entry-exit points for your trades, analyse the market conditions such as technical analysis, support & resistance levels and also determine the criteria for entering and exiting your trade.

By planning your trades helps you to stay disciplined and consistent in your trading goals. So a well-defined trading plan is crucial for success in intraday trading.

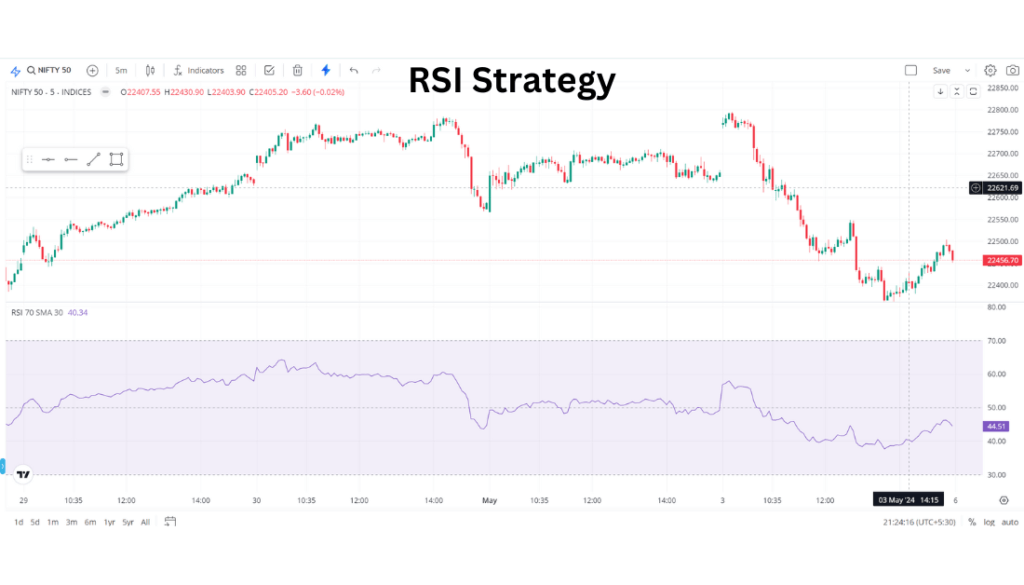

3. RSI Intraday Trading Strategy

Relative Strength Index (RSI) is a momentum indicator and used in technical analysis to detect extreme conditions. Whatever be the index or stock, if it’s currently overbought or oversold, then it can be detected with this RSI indicator.

This indicator works very well, practice this indicator, its success rate is very good. That’s why you should practice this indicator, observe and use this indicator in the live market.

RSI has two extreme ranges, one is 30 and the other is 70, which means that if any index or stock goes above 70 then it’s an overbought condition and if it goes below 30 then it’s an oversold condition.

If you follow the RSI strategy in intraday trading and if you catch even a small move, then you can easily make Rs 2000 to 3000 in a day. [Earn 2000 Daily in Intraday Trading]

4. Implementing Risk Management

Risk management is very important in intraday trading due to fast places and high volatility of the market. Keep a fixed target because if you keep a fixed target then that will help you to know when you need to exit.

Avoid risking more than 1-2% of your capital on any single trade. Always set stop-loss orders to limit your losses on each trade. Stick to your trading plan and risk management rules even if you are taking a small loss.

Keep emotions such as fear and greed in check, emotional decision-making can lead to unnecessary losses. Review your trading performance and risk management techniques regularly and try to improve them. By implementing risk management techniques you can learn intraday trading more effectively and also you can earn 2000-3000 rupees daily in intraday trading.

Read Also: Intraday Trading With 1000 Rs: A Step-By-Step Guide

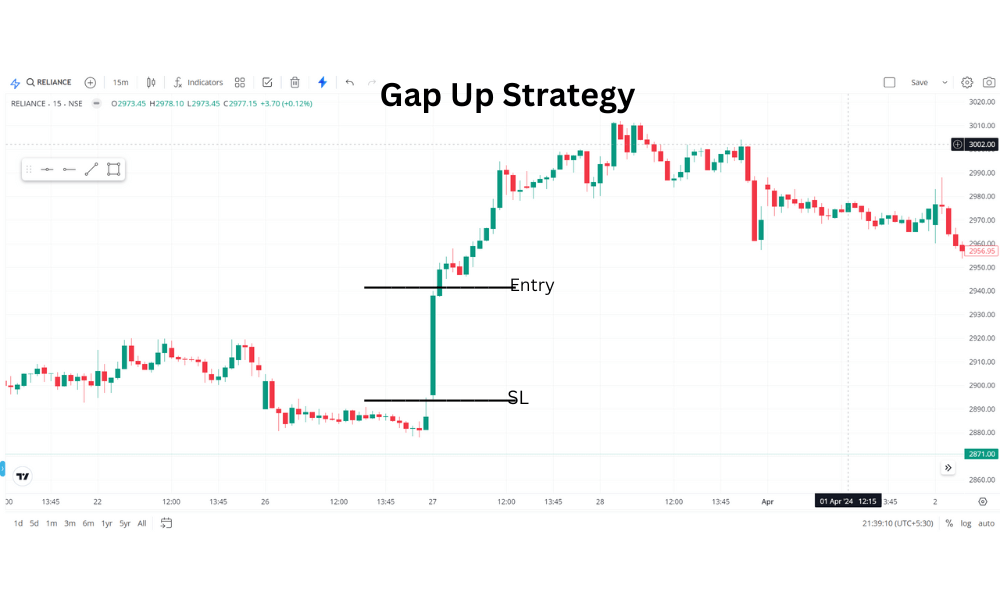

Bonus Tip: Gap Up & Gap Down Strategy

In this strategy, first of all, you have to find a stock in which there are either gap-up openings or gap-down openings. There are more than 5000 stocks in the stock market, so there are at least 5 to 10 stocks in which there is an opening gap up or gap down daily.

So, if there is a gap up opening in a stock you can take a trade to buy in it. And if there is a gap down opening in a stock you can take a trade to sell in it.

First of all, let’s talk about gap-up opening so if you see any day in a stock that the price of the stock closed below but when it opens in the next day that it goes up and opens upper side and creates a gap in the middle.

So, whenever you see such a scenario in a stock and then you see it as soon as the market opens, then there you have to do that the candle in which there is a gap up opening or the first candle of the market opening which will be a 15-minute candle and then you have to draw a line at its high point and its low point as well.

Now, if the share price goes above the high point then you have to buy a trade in that stock. Along with this, you have to put your stop-loss at its lowest point. [Earn 2000 Daily in Intraday Trading]

Now, let’s talk about gap-down opening where you will take the trade of short selling. So here also we have to do the same when our first 15-minute candle is made, then you have to draw a line from its high and low points. In this case, as soon as a candle closes below its low point then you will short there and your stop-loss will be It’s high point because you are short-selling.

In these strategies, you will be able to take only one trade a day because we have to focus only on the first candle of the market opening. So it‘s best for beginners to try this strategy when you see that according to this strategy, you are getting results, you can use it and you can increase your capital.

Conclusion

First practice all the mentioned strategies yourself, apply them in the live market and then try them. Follow all these strategies with consistency and start observing 10 to 15 stocks.

This means that your trading style, your winning rate or probability will improve to a great extent and whatever is your daily target of making profit of Rs 2000 to Rs 3000, you can easily achieve it.

I hope you have liked the information we have shared in this article, to know more about trading you can read our other articles too. [Earn 2000 Daily in Intraday Trading]

FAQs

1. How much can I earn daily from intraday trading?

Yes, you can earn 2000 to 3000 rupees daily from intraday trading which is possible but not guaranteed. It totally depends on your skill & experience, capital size, market condition, strategy and risk management system.

2. Which stock is best for intraday trading?

5 best stocks for intraday trading:

- Tata Motors

- BEL

- NHPC

- BPCL

- SBI

3. How to earn daily from trading?

Earning daily from trading is challenging but not impossible. To earn daily from trading you have to start always small, follow proper risk management, develop a trading plan and it requires continuous learning and practice.