If you want to make consistent profit in option trading then for this you will have to do continuous learning and practice about the stock market and when we talk about consistent profit then experience matters a lot in this, you will get experience with time and you can be a profitable trader.

Along with learning option trading, you should know all the basic and advanced things, you should learn about risk management.

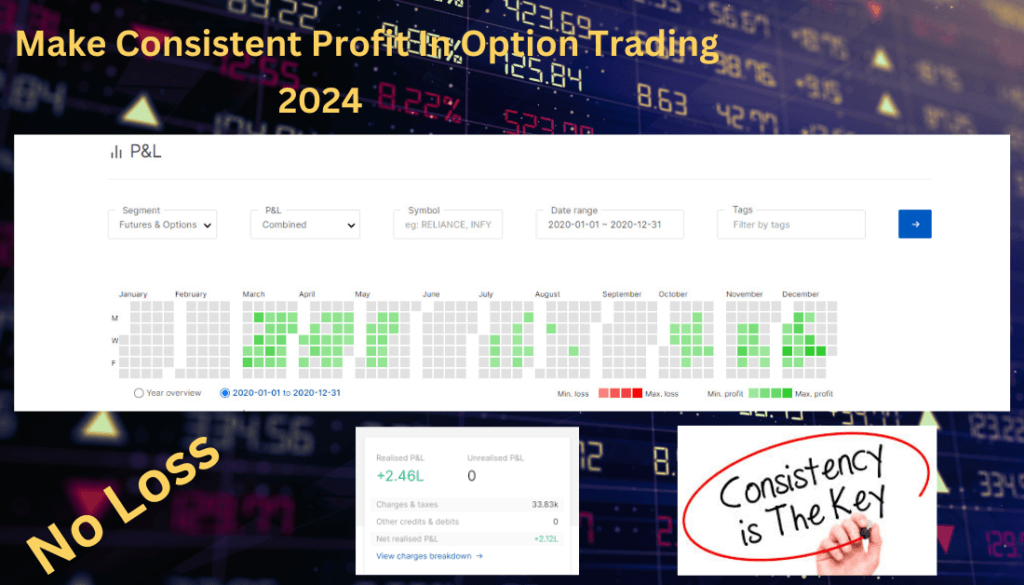

If you trade in Banknifty, Nifty options then you have to learn to make consistent profits and only then after the end of the month, you will see that you are in overall profit.

So in this article, will be told some such best rules through which you will learn to make consistent profit in option trading.

Rule 1: Experience will teach you everything

Experience will make you a profitable trader with time. Never think that you have to do something different in this, but if someone thinks that he will become a profitable trader after 3 years, then he can never become one.

Only the one who is continuously working hard regularly or learning like this will become successful. You can become a profitable trader only if you have been on the charts or you are learning from courses or continuously studying the charts.

Now what are the things that you have to learn in the experience, you have to learn to avoid the trap, you will go through the trap not once or twice, but thousands of times, but when you learn or understand the thing, then you will be able to recognize the trap.

So, beginners make many mistakes, either they do not want to gain experience or they don’t want to learn or they don’t want to understand the market and when they understand they are not waiting, they do not wait for proper retracement or accumulation zone.

If a beginner wants to make consistent profit, then this rule should be very clear that experience will teach you everything with time but you keep giving your input over time like reading charts, learning volumes, understanding market sentiment and applying it. [Make Consistent Profit in Option Trading]

Rule 2: Always trade on time

You have to always learn to time your trades and identify different types of trades and to identify you have to use the highest supply and demand. Learn to manage risk along with supply and demand.

Always try to buy any stock when it has high potential and when the supply area is very small and the demand area is very large. You will see these demand and supply areas in the chart itself.

Keep in mind that you have to buy when any stock is repeatedly reflecting in your demand zone, that means it’s taking support on the same zone again and again.

If your timing is perfect when you take a trade on any stock, then you start seeing immediate progress, that means there is support and will try to go up from there, but if your timing is wrong, then the charts will start giving you indications in advance because the market will start spending more time on the demand zone and may give a breakdown. [Make Consistent Profit in Option Trading]

Rule 3: Maintain risk and reward relation

Learn to maintain your risk and reward relationship completely. Try that your risk-reward ratio never deteriorates. If you want to make consistent profit in the market, then risk and reward have a huge contribution.

If you want to increase your super performance, learn to cut your losses early and gradually increase your winning trades by taking fractions.

The risk-reward ratio works on your risk capital, typically it should be 1:2, which means if you are investing ₹1, you should be earning ₹2. So, when you define the stop loss, never think of this when you are trading in the market.

How much profit will I make? Always think about how much I can spend in this trade and I have to make profit twice as much as it takes.

The relevance of the risk-reward ratio 1:2 is this. Suppose, if you take 4 trades, 2 trades are right and 2 trades are wrong. You will still make 50% profit.

Even if you are accurate 50% of the time which is the average if you do nothing, if you trade 50% of your trades will still be right, then even if 50% of the time you are right, you can still make money because your risk reward ratio is 2:1. The higher the risk and reward, the better your trades will be. [Make Consistent Profit in Option Trading]

Read Also: 10 Best YouTube Channels for Options Trading in India

Rule 4: Take feedback from the market

Always try to take feedback from the market. Charts and volume in the market will always try to tell you something and that’s why you should also take feedback again and again and on the basis of that, if the market is giving you the indication that your analysis is working correctly. If yes, then you can take more aggressive trades.

If you are having back-to-back losses then the market will give you an indication that your strategy is not going right then reduce your position size.

Many people have repeated losses so they make the position size bigger and then bigger losses occur, that’s why it’s very important to always take feedback from the market.

Rule 5: Stick to only 1 strategy

There should be only one strategy and that should be the golden strategy. Always remember that you will not make money by changing the strategy again and again.

The biggest mistake that beginners make is that they change their strategy again and again, due to which they end up in ultimate loss. Sometimes you follow the strategy of a YouTuber, sometimes an experienced trader or someone else’s strategy and then your psychology in that strategy doesn’t work because you were doing it with someone else’s strategy.

That’s why after collecting knowledge from everywhere, you should make a personal strategy which should be your golden strategy. There is no harm in doing it strategically, It’s most important to get confidence in doing it.

It means that you are doing with your own strategy but you do not have the confidence, so there is no use of this, that’s why it’s very important to have confidence in your own strategy. [Make Consistent Profit in Option Trading]

Rule 6: Take concentrate trade not diversified

This rule always says to focus your attention and focus your capital but many people think that we have to diversify into different stocks whereas pro traders narrow down their portfolio and focus only on close stocks.

Therefore, depending on your trading style, you should gradually focus only on that particular two or three stocks. If you are trading in the index then do not trade on stocks and also if you want to trade on stocks then do not trade in the index. Focus should be like Banknifty, Nifty or Sensex whatever you like if you are trading in the index.

And if you want to trade in stocks then do it only in three-four stocks. If you are making a portfolio then don’t exceed more than three or four stocks. When you select the best group of stocks you should focus on which have great potential in the future.

If there is too much market place or it will give too much return then in this case, your probability of success increases. If you look at it in the general context, big traders or investors, these people invest their money in big stocks from where they get good returns. [Make Consistent Profit in Option Trading]

Read Also: 5 Best Indexes for Options Trading in India

Bonus Rule: Plan your trades and let profit run

Learn to plan your trades before executing any trade. Plan each trade including profit, target and risk management. The advantage of planning your trades is that you know when to cut your losses and book your profits.

Along with planning the trade, you also have to identify all these things like entry and exit points, candlesticks, charts, indicators and support/resistance.

By holding winning trades and letting profits run while managing risk, you can optimise your trading results and increase the probability of your trading strategy. Doing all this increases your success rate of making consistent profits.

Conclusion

If you want to make consistent profit in options trading, then first of all learn to respect the market, whatever is your target or stop loss, whichever one hits you, respect it and exit the trade immediately.

If you sit in the market and then go to recover the loss or think about it, then you will only go into losses. Whenever you take a trade, if your target is hit then you can prepare for another trade or if your stop loss hits so it’s better to stay away from the market.

That’s why if you follow all these rules carefully then you can make consistent profit it’s not made from money. Consistent profit will be made on how sharp you are mentally, you should have different levels of thought processes running in your mind that every person can’t think and only then you will start making consistent profits.

I hope you have liked the information we have shared in this article, to know more about options trading you can read our other articles too. [Make Consistent Profit in Option Trading]

Make Consistent Profit in Option Trading (FAQs)

1. Is it possible to make consistent profit in option?

Yes, it’s possible to make consistent profit in option it can be challenging and requires a solid understanding of the market, risk management and strategy.

2. What is the success rate of option trading?

The success rate of traders who trade in option trading is 70 – 85 %.

3. How to make consistent profit in Nifty options?

You can make consistent profit in nifty options by implementing proper risk management, target, stop-loss and entry-exit points. In nifty options, your risk-reward ratio should be 1:2.

Valuable content

Thank you