Moving Averages for Options Trading: The moving average is one of the most famous technical indicators not just in India but around the world. The interesting part about the moving average is that it’s used not just by traders but also by long-term investors.

Traders use moving averages to find short-term technical trends in the stock whereas investors use them to find long-term investment opportunities.

Whether you work in the stock market, future & options, commodities or forex market, moving average works very well in every market. The most important thing about the moving average indicator is that when you work with the moving average, you can easily understand the market.

Definition – Moving Average

Moving average is a trend-following indicator. Its purpose is to detect the start of a trend, follow its progress, as well as to report the reversal if it occurs.

A moving average is one of the most flexible as well as most commonly used technical analysis indicators. It’s highly popular among traders, because of its simplicity. It works best in a trending environment.

There are mostly only two types of moving averages in option trading, one is Simple Moving Average (SMA) and the other is Exponential Moving Average (EMA). EMA is more accurate than SMA, that’s why most of traders like to use both these moving averages.

Read More: Can I Start Options Trading with 1000 Rupees?

Best Moving Averages for Options Trading:

Many types of moving averages are used in the stock market, but the question here is which moving averages should we use for option trading? So in this article, we will tell you such moving averages which you can use in options trading to improve your trading skills.

1. 9 EMA: If you want to do scalping in options trading on a 1, 3 and 5-minute time frame then you can definitely use 9 EMA. Its simple strategy is that the market is more likely to be traded on the side where it breaks the EMA and closes which means the probability is high. But if you are scalping then you should look for small targets only.

But in this you have to keep in mind that there should be a little movement in the market. If there is a sideways market then you can avoid trading.

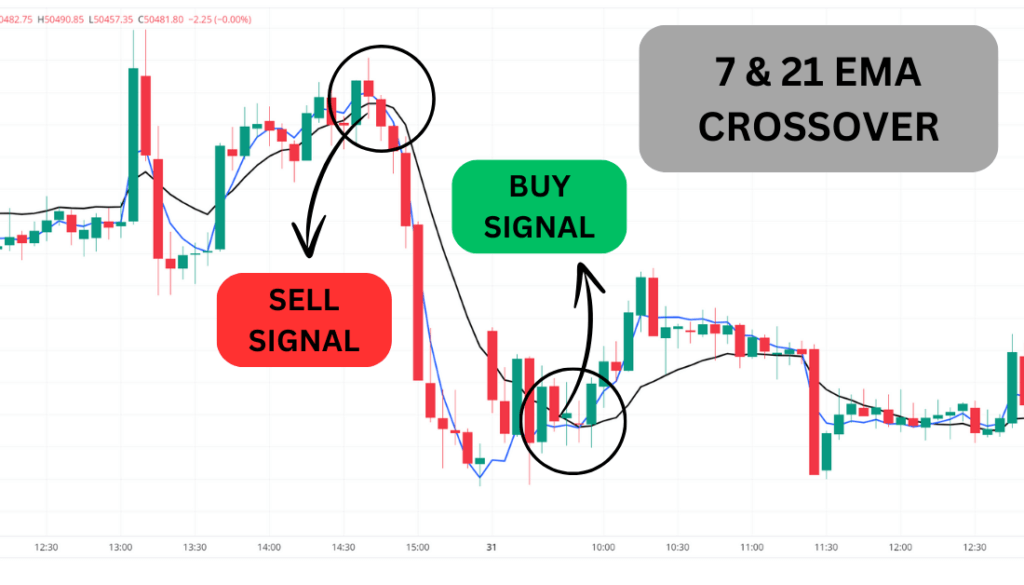

2. 7 and 21 MA: If you are a short-term trader or option trader, then you should use 7-day and 21-day moving average combination. This is a short timeframe moving average, that’s why it is called Fast MA. Due to the up and down movement of Fast MA, we get buy and sell signals.

When 7 MA crosses 21 MA from bottom to top then we get the signal to buy which we call bullish crossover and as long as the 7-day moving average is in the direction above the 21-day moving average then the market is in bullish trend.

Conversely, when the 7-day moving average crosses the 21-day moving average from top to bottom, we get a sell signal and it is also called a bearish crossover as long as the 7 MA is in the direction below 21 MA. Till then the market is in bearish trend only.

And until both these moving averages rotate and crossover each other in opposite directions, trend reversal does not occur. [Moving Averages for Options Trading]

3. 21 and 50 MA: If you are a medium-term period trader, then you can use the 21-day and 50-day moving average combination. These two moving averages also help in identifying support and resistance when the price manages to move higher by taking support above 21 and 50 MA, then it’s considered a sign of a successful bullish trend.

And whenever the price forms support above 50 MA, we get a buy signal and it indicates a bullish trend continuation.

Whenever the price succeeds in falling continuously by taking resistance below both the 21 and 50 MA, then it’s considered a sign of a bearish trend and whenever the price becomes resistance below both the moving averages, we get a sell signal.

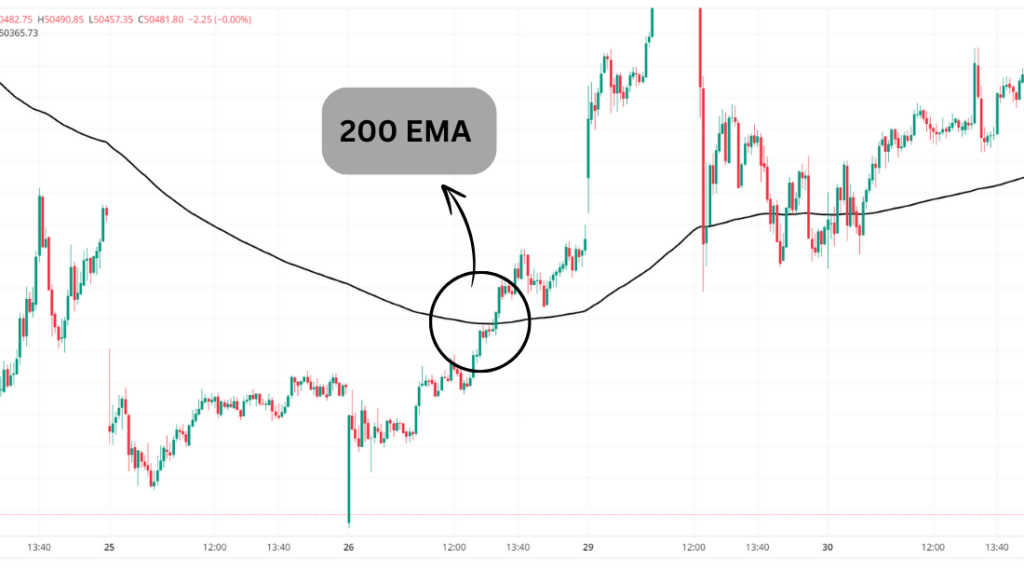

4. 200 MA: If you are a long-term period trader then use a 200-day moving average and it’s called slow MA and this MA helps us in knowing the market trend.

You get to see high accuracy on this 200 MA, but you will get less signals in this, you can use this MA in any time frame like 5 minutes or 15 minutes but the bigger the time frame, the better will be its accuracy.

If you see any stock or index crossing 200 MA in 5 minute time frame then you will get a perfect momentum trade.

All the moving average combinations that have been mentioned are preferred by traders around the world and considered the most reliable moving average combinations. However, you can also change the moving average as per your convenience. [Moving Averages for Options Trading]

Read More: How to Become an Expert in Options Trading 2024

Buying with Moving Average Combination

Before we understand how we can buy with the combination of moving averages, you will use 7 and 21-day MA. If in the chart we see that 7 MA is crossover 21 MA from bottom to top. Then to buy we have to see that the candle in which the bullish crossover of the moving average is taking place is the one in which we have to buy.

After buying, we have to put a stop loss at the low of this candle in which the crossover of the moving average is taking place. Meanwhile, before taking the trade, you have to keep one more thing in mind that the middle of the stoploss from the point of your buying. The difference should be as per 2% of the risk-reward ratio only then you have to take the trade.

If the difference is not as per the rule of 2% then you do not have to take this trade. After taking the trade you have to use the trailing stop loss. After this, for profit booking, you have to see that if your trailing stop loss is hit or not. You can consider it as your profit book or you do not have to book profit until there is a bearish crossover of the moving average.

When there is a bearish crossover of moving average, then you have to book profit immediately, then you can buy with the combination of moving average. In a similar manner, you can buy using moving average combination. [Moving Averages for Options Trading]

Selling with Moving Average Combination

If we see in the chart that 7 MA is crossing 21 MA from top to bottom, then to sell we have to see that in the candle next to the one in which the moving average is having a bearish crossover. After selling, we have to put a stop loss above the high of the candle in which the bearish crossover of the moving average is taking place.

Meanwhile, before taking the trade, you have to keep one more thing in mind that the difference between your selling point and the stop loss point should also be as per the rule of 2% of risk-reward ratio, only then you should take the trade.

After taking the trade, you have to use the training stop loss. After that, for profit booking, you have to see that if your training stop loss is hit or not. Then you should consider it as your profit book or until there is a bullish crossover of the moving average. You do not have to book profit till then

When there is a bullish crossover of MA, then you have to book profit immediately, then in the same way you can do selling combination of moving average. [Moving Averages for Options Trading]

How Does Moving Average Work?

Traders use moving average in some ways. Traders put different moving average settings together in the chart and get confused. First of all, let us understand how we can identify the trend with the help of moving average.

To identify the trend with moving average, you will have to put a moving average of 50 days in the chart. To identify the trend, the setting of 50-day MA is considered the best. However, you can do other settings as well to identify the trend, but most traders use settings of 50-day MA.

When the price crosses the 50-day moving average and goes up, then it indicates that there is a bullish trend in the market. On the contrary, when the price crosses the 50-day moving average and goes down, then it indicates that there is a bearish trend in the market. [Moving Averages for Options Trading]

Conclusion

Moving average is so useful that it will be useful in every chart and will help you to confirm your trade many times. It will help you to save your loss many times and it will also help you to tell the trend many times that means it has many uses.

So in this article, we have discussed about some of the best moving averages for option trading. Apart from this, you can also use them as per your choice like 9-day and 15-day MA, it totally depends on you.

I hope you have liked the information we have shared in this article, to know more about options trading you can read our other articles too. [Moving Averages for Options Trading]

Read More: How to Make Consistent Profit in Option Trading 2024

Read More: Best Time Frames for Option Trading in 2024

Frequently Asked Questions —

Which is the most successful moving average strategy?

The most successful moving average strategy is the crossover strategy. In this strategy, If 7 MA crosses 21 MA from bottom to top then it generates buy signal and if 7 MA crosses 21 MA from top to bottom then it generates sell signal.

Which 3 moving average should I use?

You should use 21-day, 50-day and 200-day moving averages because all these moving averages help you in identifying trends, support/resistance and also in finding overall trades.

Which indicator is best for option trading?

List of 5 best indicators for option trading:

- Exponential moving average

- Moving average convergence divergence

- Relative strength index

- Volume-weighted average price

- Fibonacci replacement

I have benefited a lot from learning about the business plans sent for the series on the stockwart.com website.Many thanks to the owner of this website.

I love how this blog gives a voice to important social and political issues It’s important to use your platform for good, and you do that flawlessly

Thank you very much

Superb layout and design, but most of all, concise and helpful information. Great job, site admin. Take a look at my website YV6 for some cool facts about Airport Transfer.

The writing style is like a signature scent—distinct, memorable, and always pleasant.

Thank You so much

The post was a beacon of knowledge. Thank you for illuminating this subject.

Thank you for spending your valuable time on our blog.

The article was a delightful read. It’s clear you’re passionate about what you do, and it shows.

Thank you for spending your valuable time on our blog.

The post provoked a lot of thought and taught me something new. Thank you for such engaging content.

Thank you so much

Distilling hard to understand concepts into readable content, or what I like to call, a miracle.

thank you for your feedback

The insights added a lot of value, in a way only Google Scholar dreams of. Thanks for the enlightenment.

Thank You

Beautifully written and incredibly informative, The post has captured my attention as if it were a love letter written just for me.

Thank you so much for ypur love

I’m genuinely impressed by the depth of The analysis. Great work!

Thank you so much

The balance and fairness in The writing make The posts a must-read for me. Great job!

Thank you so much

Amazed by The knowledge breadth, or what I’ve been mistaking for just good Googling skills.

Tnaks a lot

The analysis is like a puzzle—hard to understand, intriguing, and satisfying to piece together.

Thank you for your feedback

Each article you write is like a step in a dance, moving us gracefully through The thoughts.

Thank You

Testament to The expertise and hard work, or The ability to make me feel utterly unaccomplished.

A masterpiece of writing—you’ve covered all bases with such finesse, I’m left wanting an encore.

Thanks a lot, Keep supporting

The attention to detail is remarkable. I appreciate the thoroughness of The post.

Thank you

The post touched on things that resonate with me personally. Thank you for putting it into words.

Thank you Buddy. Keep supporting