Best Time Frames for Option Trading: If you are a beginner and you want to choose the right time frame then it completely depends on you because which time frame seems right to you and which one suits you, accordingly you have to choose that time frame.

After choosing the time frame, you will have to work on this with dedication so that you become an expert in that time frame and you have to know how to take trades in that time frame.

Time frame is very important in the stock market. In short, time frame gives you a view of what is going to be the duration of the trade i.e. what is the duration of whatever trade you are taking, the rally is decided by that time frame.

If you use only one time frame while trading, then you will get to see a lot of fake signals there and because of this, you will make a loss.

That’s why whenever you are trading the most important thing is that you have to analyse a chart on multiple time frames. [Best Time Frames for Option Trading]

The Best Chart Time Frames for Option Trading

To choose the best time frames for options trading depending on your trading style, preferences and market conditions. You also need to check different time charts, there are some time frames used by traders –

1. 1-minute time frame: Suitable for very short-term traders who make quick decisions based on rapid price movements. This timeframe requires constant monitoring and quick execution.

It’s crucial to have a clear strategy, strict risk management and stay updated on market news.

2. 3-minute time frame: A 3-minute time frame for option trading still requires swift decision-making but allows a bit more time for analysis compared to a 1-minute time frame.

A 3-minute time frame works very well in big bar candles for options trading and your execution speed needs to be very high on this time frame.

3. 5- 5-minute time frame: A 5-minute time frame is best for scalpers and intraday traders. Execution speed is very good in this time frame. You can control your trades on this time frame and can manage your entry-exit and stop-loss very well.

Your stop-loss should also be manageable and if you want to get the targets quickly then 5 minute time frame is best for this. It’s not too risky because you get time to think and you can make multiple decisions to make your decision with the proper time.

4. 15-minute time frame: The 15-minute time frame is best for market analysis and trendline draw. This time frame Is more stable, smooth and less volatile of price movements. 15-minute time frame is more flexible and it also offers a broader view of price action.

5. 1-hour time frame: The 1-hour time frame is used by traders for options trading to identify market trends and also helps to mark the support and resistance levels for executing trades.

6. 1-day time frame: The 1-day time frame is best for market analysis and also helps to draw support and resistance levels. Experienced traders also use this time frame to know about the overall trend of the market.

The importance of 1-day time frame in option trading depends on your trading style, strategy and risk management. [Best Time Frames for Option Trading]

Should I trade in the first 5 minutes?

You can trade in the first 5 minutes (09:15 am – 09:20 am) of the market opening in trading day but it can be quite risky due to high volatility and uncertainty.

You can trade in the first 5 minutes it’s generally recommended for experienced traders who can make quick decisions and also can quickly react to the market movements with proper risk management because it can create some opportunities to make profits if you trade well.

It’s not recommended for those who are beginners in options trading because it requires research, experience, discipline and you have to understand the trading strategies before making any trades.

So if you want to trade in first 5 minutes of market opening in option trading it totally depends on your experience level, trading strategy and risk management. [Best Time Frames for Option Trading]

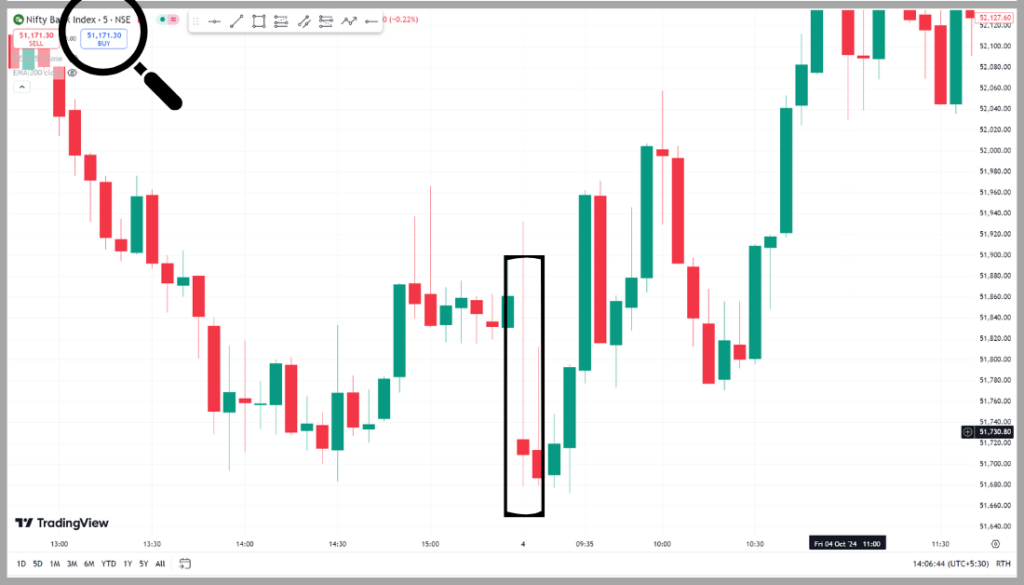

First 5-minute candle strategy:

1) Identify Buyer / Seller (candle formation) –

The first step is to identify whether the market is going from a buyer or a seller. For this, we have to see how the pattern has formed in the market or how the candle has formed.

2) Mark Support & Resistance –

The second step is that we have to mark the previous day’s high and the previous day’s low i.e. support & resistance of the previous candle.

3) Market Opening –

The third step is to know where the market price is opening. For example, the market is opening gap up, the market is opening flat or the market gap is opening down.

If a huge gap up opens, we will not initiate the trade. At the same time, if the market gap down also opens, we will not initiate any trade. If the market opens flat then only we will think about taking our trade.

4) Make decision within 10-20 sec before candle closing –

The fourth step is that whenever the market comes to 09:20 am, we have to take a decision within 10 to 20 seconds before 09:20 am whether we will take the trade in it or not.

5) Wait for target or Stop-Loss –

The fifth step is that after we initiate the trade we have to plan till our target or if our stop-loss hits then we should exit our trade. [Best Time Frames for Option Trading]

Read Also: How to Make Consistent Profit in Option Trading

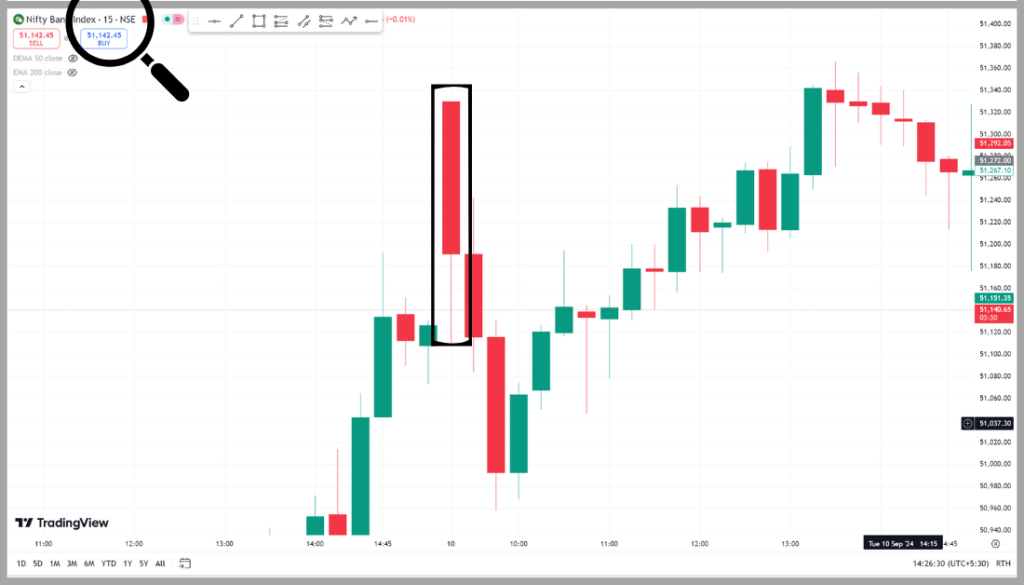

Should I trade in the first 15 minutes?

Yes, of course you can take trades during the trading session at the time of market opening i.e. in the first 15 minutes (09:15 am to 09:30 am), but it’s also a bit risky.

But taking trades in the first 15 minutes of market opening is not at all recommended for a beginner, because market prices are volatile due to there is increased uncertainty and fast price movements. That’s why according to me, a beginner should wait until the market settles down (after 9:30 am).

On the other hand, many professional traders keep looking for good opportunities during market opening, and these people also make good profits during this time, because the volatility is very high at the time of market opening.

At the market opening, i.e., in the first 15 minutes, if you have a solid strategy and trading plan such as taking trades on breakout or breakdown, trading under support and resistance, gap up and gap down, or trading by looking at the volume, you can trade in the first 15 minutes, which is also considered a good approach.

You can see that the candles formed in the initial period are very big and the market also remains volatile during this time. At this time, the market is bound to be highly volatile and also difficult to take decisions as to which direction the market price will move now.

So if you want to trade in the first 15 minutes, then you must have experience, discipline, trading plan and a solid strategy. But if you are a beginner then follow my advice and stay away from taking trades during this time period and just observe the prince movements. [Best Time Frames for Option Trading]

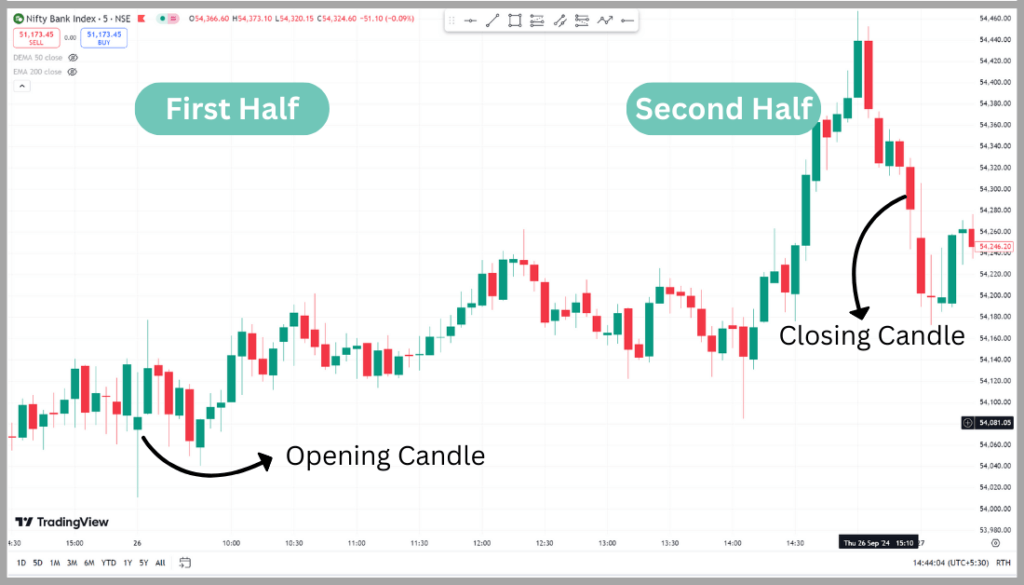

Should I Trade in the First Half or the Second Half?

You can trade in the first half or you can trade in the second half. It totally depends on your analysis, trading strategy and your own setup. You can trade at any time as per your convenience market hours.

9:15 am to 10 am is a volatile market but it’s not so very volatile because by 9:15 to 10 am few indexes or stocks will go up, few will reverse down, some may come in trending top gainers and you will get to know which are performing good.

Market will come to either some direction you will get to know which side the market is but the movement will be still very fast over here 9:15 to 10 am, so in this timing you can take a lot of advantage if you have a good strategy.

Again beginners can stay away but if you have some experience, you have strategy or any breakouts you know you can utilize based on those accuracy. 9:15 to 10 am in this timing you will see that your targets will achieve faster. But there can be a little bit of reverse also which happens during this time.

If you are a beginner you don’t want high risk or you just want to be safe then this timing 10 to 11:30 am will be best for you which is a stable market. In this timing, it may take some time to achieve your target but it’ll not be very quick it will be a little bit slow and steady assumptions and whatever you predict the chances will be higher. If you see here because you have a proper understanding that the market is going up and many things you can analyze in this particular time frame.

In the second half 2 to 3:30 pm this time frame again you can see the volume is picking up. There can be big candles, big moves and sudden fall will be there after 2 pm but the volatility and the candle size again will get bigger.

A lot of traders who want to take advantage end of the day like after 2 or 2:30 pm suddenly a big spike is there, so many people can take advantage who have a proper strategy. [Best Time Frames for Option Trading]

What time frame should scalpers use?

First, let us understand what is the meaning of scalping. The simple meaning of scalping is to make quick entry and quick exit. If you take entry in the market then within a minute or a few minutes you exit it from the state.

It’s obvious that this scalping is not easy because it’s difficult for many people. Because of a normal retail traders or beginners, if they are not able to earn money even by sitting for a whole day, then scalping for a minute or two is very difficult for them.

Secondly, a beginner should not get into scalping. This is because unless you make yourself a command to trade on the 15, 30, 45 minutes or 1 hour in these time frames, it’s difficult for you to trade on smaller time frames like 1, 3 and 5 minutes that’s why beginners should master their intraday trading.

A question arises in the minds of many people that they should take a time frame of 15 minutes on scalping, the answer is absolutely no. The simple reason for this is that as soon as you disrupt your time frame, your risk in scalping increases and your stop loss also increases because the candle becomes bigger in 15 minutes compared to 1, 3 and 5-minute candles.

Your risk also gets involved in this process, that’s why the probability of losing money increases more, especially if you do scalping.

In scalping, entry and exit should be quick because the mindset or analysis of a scalper is completely different as compared to that of a swing trader, positional trader or investor.

You have to understand one thing that as you become a master in scalping, both your execution speed and execution platform should be good.

A pro experienced trader can do scalping on 1 or 3 minutes as their execution speed and strategy are very good. But if you are a beginner I would recommend you to stick with 5 minutes and improve your knowledge and trading skills. [Best Time Frames for Option Trading]

Read Also: 10 Best YouTube Channels for Options Trading

Which time frame is best for options trading 5 min or 15 min?

Most common time frames used for option trading are 5 minutes and 15 minutes.

| 5 min time frame | 15 min time frame |

|---|---|

| Best for entry-exit | Best for market analysis and trendline draw |

| More signals but also fake signals | Less signals but quality signals |

| High volatility | Smooth and less volatility |

| It allows traders to capture shorter-term price movements | It offers traders a broader view of price action |

| More active monitoring and quick decision-making | More flexible |

If you want to choose 5-minute and 15-minute time frames it totally depends on your trading style, risk management and your own setup. Many traders use a combination of both time frames to gain a comprehensive understanding of market dynamics and improve their trading skills. [Best Time Frames for Option Trading]

How do experienced and professional traders choose their time frames?

Experienced traders prefer to trade in very short time frames like 1, 3 and 5 minutes because experienced traders do not always depend on calculations or strategies. They have their own trading setup or trading style.

Pro traders take multiple trades in a single day so quickly because their execution speed and trading strategy are very good and also their decision-making is very strong that’s why they execute trade quickly and exit quickly.

On the other hand, there are many traders who take only a few trades in a day and choose a longer time frame.

Scalpers and day traders use short time frames for quick trades, while swing traders use hourly or daily time frames for big moves because they have their personal trading style. [Best Time Frames for Option Trading]

Conclusion

So, lots of beginners who don’t know about timing, timing is very important in options trading It’s not just picking an index or stock or just exiting with a 0.3 target or all those things but timing to trade is also important.

Choosing the best time frames for option trading also allows you to align your trading strategy with the current market conditions, volatility, liquidity and trading style.

Hope this article has helped you, let me know in the comments which is the best time frame according to your experience because different people have different experiences.

If you are a beginner and want to learn more about options trading then you can read other articles on this website. [Best Time Frames for Option Trading]

Frequently Asked Questions –

1. What are the best times to trade options?

9:15 am – 10:30 am and 2:00 pm – 3:30 pm, these times are best for options traders because during these time periods, we can see mostly higher volatility. You have to find opportunities within these times to execute the trade. These time periods are more suited for experienced traders who can handle the rapid price movements.

2. Which time frame is best for trading?

5-minute and 15-minute time frames are best for trading, Traders can use 5-minute chart time frame for entry and exit and 15-minute time frame for market analysis and trendline draw.

3. What is the time of F&O?

Trading hours for F&O are from 9:15 a.m. to 3:30 p.m.

4. Should you trade the first 15 minutes of the day?

If you want to trade in the first 15 minutes, it is a little bit risky because the market is very volatile at this time. On the other hand, the first 15 minutes of the day also give you a lot of opportunities through which you can make a good profit for those who are able to react quickly and effectively.

Fine topic for trading

Thank.

Thanks! I’ve been searching for information on this topic, and your blog is the best I’ve come across. I’m looking forward to more posts from you.

Yeah for sure